If you’re an intermediate to advanced trader who’d like to stretch beyond basic trading strategies, options are a natural choice. Options are a popular and powerful tool that offer an added layer of flexibility and control to your portfolio. By carefully reviewing our curated archive of options content, you’ll have the necessary background to make informed trades.

Options Trading

Futures and Options: How Do They Differ?

If you’re a new commodities trader, deciding whether to trade futures or options (or both) is of the most important early decisions to make. While both strategies can generate exciting trading opportunities, futures and options also differ in some fundamental ways.

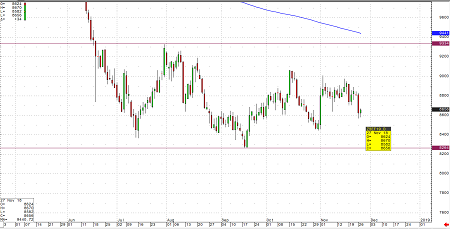

Finding Success in a Sideways Market

An informed and skilled trader, however, can generate returns in any market — bull, bear or sideways. In fact, if you’re armed with the right information and strategies, a sideways market can offer plenty of trading opportunity. To help you better understand what’s involved, let’s take a closer look at the basics of sideways markets.

Learn what options on futures are, options trading and how to implement it in your futures trading plan. Why Options Trading on Futures?

Weekly Options are essentially the same as standard options in every respect but duration. They have the same strike prices and ranges, the same underlying contracts, and the same settlements. They have many benefits, two of the most important being affordability and flexibility.

Hedging futures is a way to possibly reduce your risk while trading. Learn the basics of hedging along with some examples of how hedging equity futures works. What is Hedging? The word hedge means protection.

A strangle option is an options trading strategy where the investor holds both a call and put option with different strike prices, but the same expiration date. A strangle option is a useful strategy to use when the trader believes there will be a major price movement in the underlying asset but are unsure in which direction it will move.

In this blog, we dive deep into the world of options trading strategies, discussing what they are, how they work, and why they matter. Learn more now.