First developed by Donald Lambert, the Commodity Channel Index, or CCI, is a technical trading tool that measures the momentum of a certain investment to help determine if that investment is in danger of being overbought or oversold. In a more technical sense, the CCI takes an investments price and measures its change in relation to the pre-defined moving average (MA) divided by 1.5% of that average’s normal deviation.

Commodity Channel Index Formula:

CCI = Price – MA/.015 x D

The CCI is categorized as a stochastic oscillator because it using oscillating indicators to measure values between two pre-determined values. Essentially, the CCI measures a securities price change against its average price change in coherence with the two predetermined values. When a measurement is near the top pre-determined value, an investment is in danger of being overbought, and when a measurement is near the bottom value, an investment is in danger of being oversold.

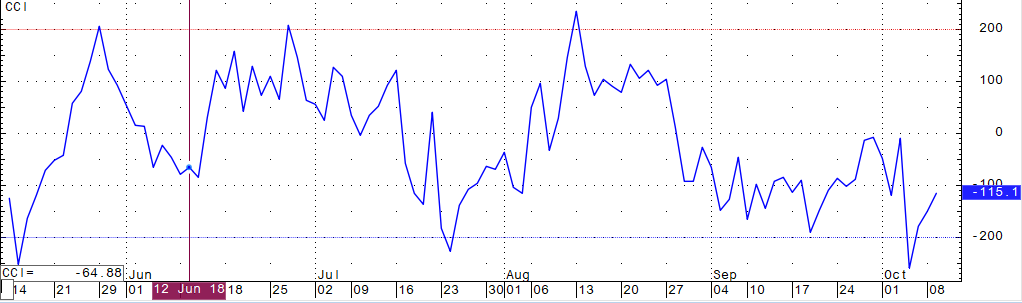

Commodity Channel Index Chart

CCI as a Technical Trading Tool

As mentioned previously, the CCI is an oscillating trading tool, which means that it helps traders identify when a market is nearing the end of its existing trend. When a market has been in the same trend, it becomes in danger of being over bought or oversold and the CCI helps identify this. The CCI can also help traders identify price reversals, trend strengths, and price extremes. These characteristics are what separates the CCI from a trend-based trading tool, which is a tool that seeks the ability for traders to capture an investment at a long term price. Neither tool can be considered better than the other, they both have positives, and are both useful for traders and can help increase their profits.

CCI Basic Strategy

The foremost, and most basic strategy to deploy when using the CCI is to use it to track when to buy and when to sell. When the CCI is +100 that signifies it is a good time to buy because the price is above the average price, according to the indicators. At the same time, when the indicators are showing -100, it signifies it is a good time to sell, since the prices are down.

Multiple Timeframe CCI Strategy

Another popular strategy to deploy when using the CCI is the multiple timeframe strategy. The multiple timeframe strategy, most commonly used by day traders, is a strategy that is most effective when trying to establish long and short-term trends. These trends are established by using a long-term chart to get a feel for the market trend, in addition to a short-term chart to nail down entry-points. When the long-term chart signifies an uptrend (+100), a trader then goes to their short-term chart to find the proper entry point to pounce upon, and vice versa for exit points.

Recently, the CCI has been gaining steam and popularity as a mainstream trading tool. Currently, traders have been using the CCI to determine trends in currencies, equities, and commodities to help determine cyclical trends. The CCI can be used effectively on its own, but can have even more profound effects when used with other oscillators, momentum and volume indicators, and the price chart. As with many trading tools, success is never guaranteed, but the CCI does have a proven track record showcasing how useful it can be.