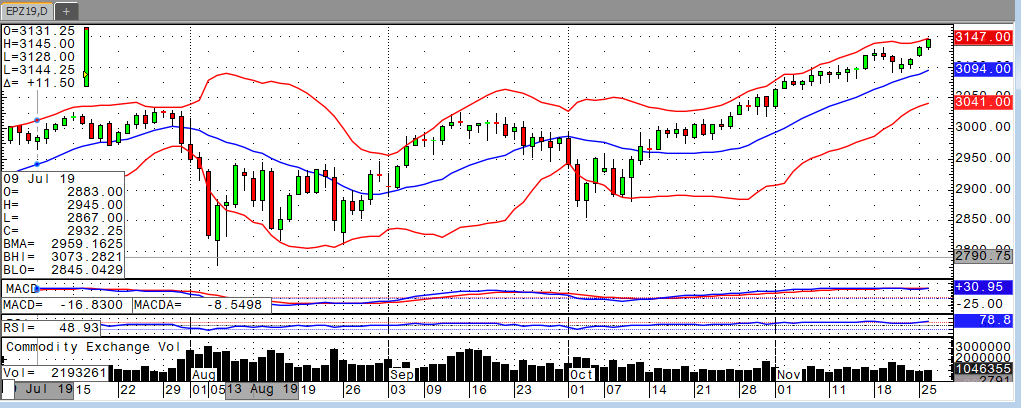

U.S. equity futures tagged another all-time high on Tuesday, with the e-mini S&P rallying nearly 10 points in the last two hours of trading. More headlines came out on Tuesday stating that the U.S. and China are “close” to a phase one deal, but it is starting to seem a lot like the boy who cried wolf. It appears as if the stock market rally is dependent on the never-ending progress in trade talks. The classic model of “buy the rumor, sell the fact” looks to be at work in the equity realm. Economic data has been on par lately, which is proving to ease investor worries that the U.S., and the rest of the world, are heading for a recession. Fed policy has once again propped up an inflated stock market, and it appears a top is not yet in place. I would look for more upside over the holiday season, unless Wednesday’s GDP number comes in below expectations and scares investors back onto the sidelines. Without a negative geopolitical event, or extremely poor economic data, it would make sense to see the stock market continue this rally into next year. First support comes in at 3116.50 in the Dec e-mini S&P, while a close under 3097.75 could cause retracement to 3063. As we are trading at all-time highs, resistance levels are not yet in place, but a close over the 3160 level will likely spark more buying into next month.