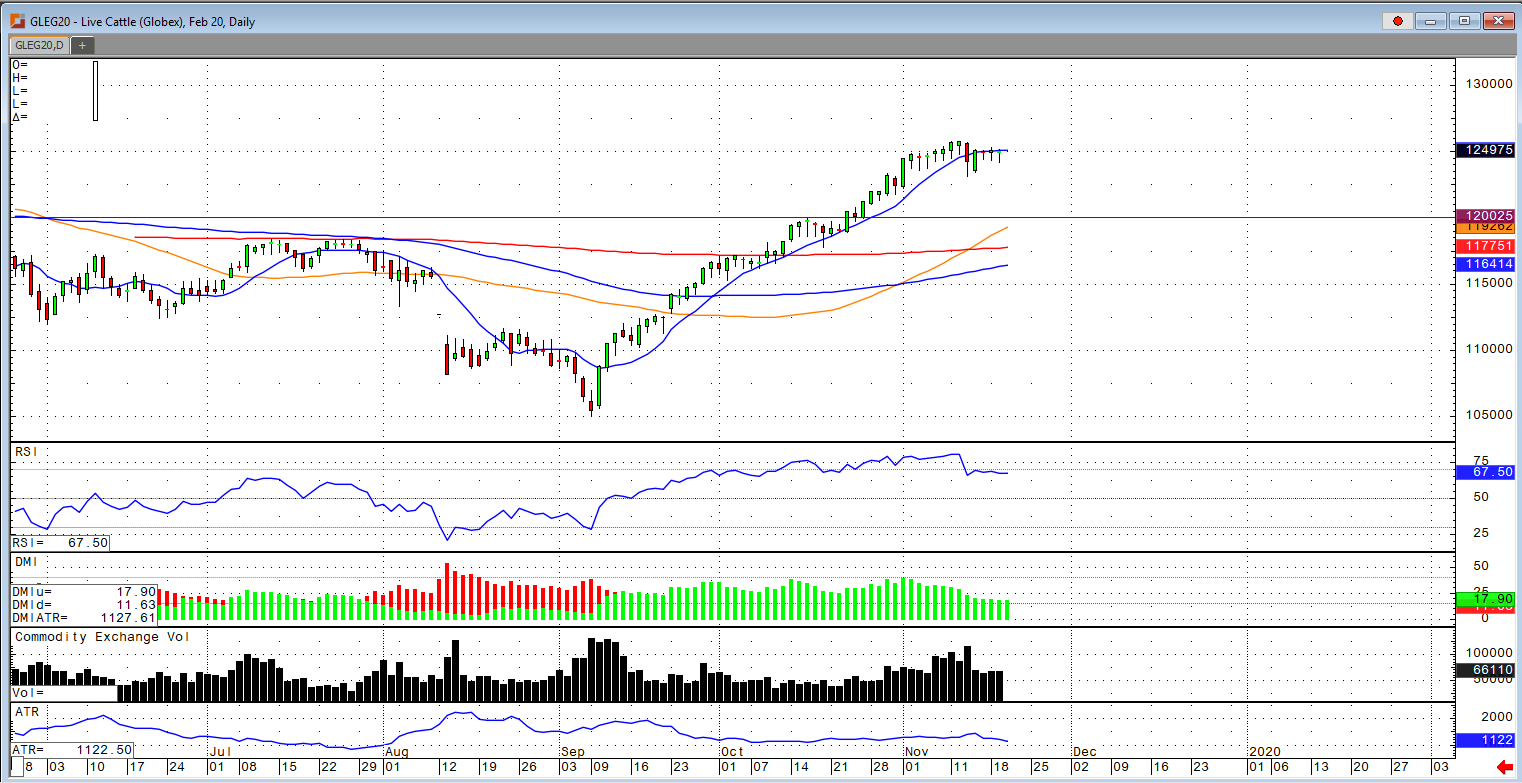

The cattle market looks a bit toppy to me right now. The estimates for the upcoming cattle on feed report came out and appear to be bearish, 101.4% is said to be the on-feed number, 112% for placed, and 99% for marketed. The higher placement number could be a bearish factor to the February and April contracts. February cattle is trading at nearly a $10 premium to the cash market with open interest continuing to trend upwards, but with a failure to close above the 10-day moving average and taking out the previous two trading session lows could signal the beginning of a turn to the downside in cattle. With the upcoming Cattle on Feed report and the large premium between the futures market to the cash, I see a market correction coming sooner rather than later with a $3-$5 dollar sell-off over the rest of the month into December. The USDA estimated cattle slaughter came in at 118,000 head yesterday. This brings the total for the week so far to 236,000 head, up from 231,000 last week, but down from 242,000 a year ago. USDA boxed beef cutout values were up 83-cents at mid-session yesterday and closed 11 cents lower at $239.01. This was down from $240.50 the prior week and the lowest beef market since November 11th. There has been no cash cattle trade in the plains so far this week but Iowa/Minnesota cattle traded at about $1.00 lower than last week to an average price of $115.61.