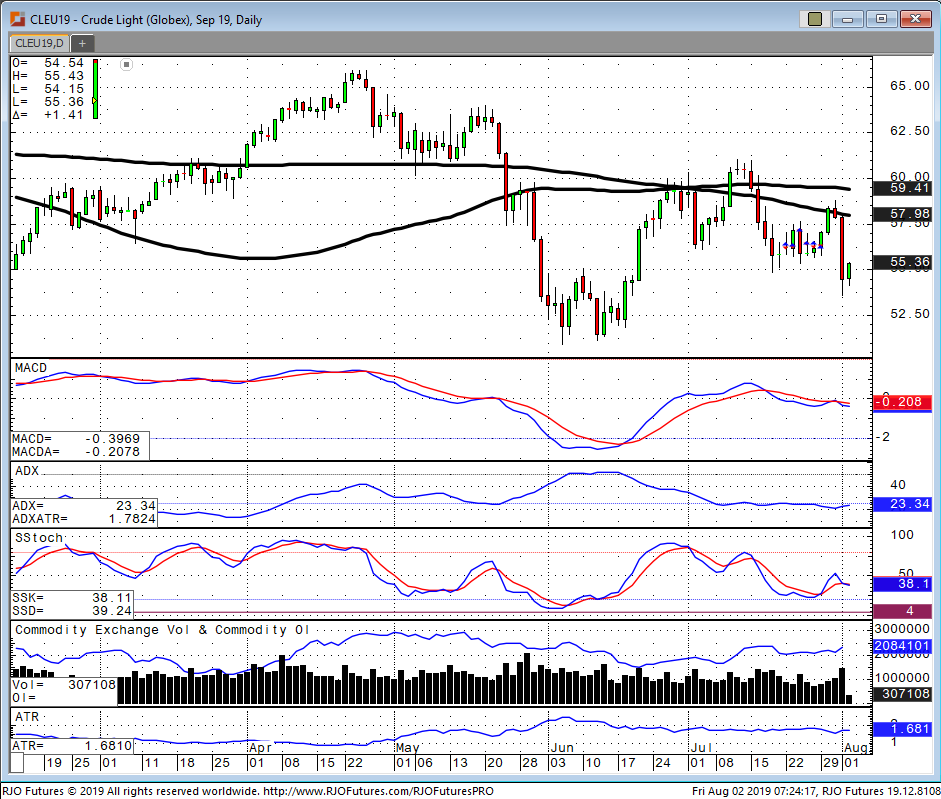

Crude oil futures have had a wild ride this week with increased volatility, lack of direction and mixed fundamentals. Looking at the supply demand structure, we are still seeing current EIA oil stocks sitting at 436 m/b and the 5-year average is 427 m/b leaving supply adequate. The FED cut interest rates last Wednesday and with the 10-year yield at 1.99% and the 3-month at 2.06, the yield curve has been inverted for several months now and could indicate that we are headed into a recession in the next 24 months. The technicals leave the market open to a potential washout into the low 50’s while the average true range is up at $1.68 meaning we see a $1680 range on a 1 lot everyday so use caution.