Powell banged the gong, but it wasn’t loud enough. Not.Dovish.Enough. was the result of yesterday’s FOMC announcement. If you listened to Powell’s press conference yesterday, it was an absolute disaster – walking on egg shells, walking back statements, etc – he sounded foolish. It’s impossible for the Fed to create or “re-flate” asset prices with the current direction of the U.S. Dollar. Mathematically impossible. The yield-curve, 2s vs 10s compressed to 14 bps on the announcement as well, despite the Fed expectations that is would steepen! This is also why Draghi likely wasn’t as dovish as the market expected last week, because he knew Powell was going to do the job for him.

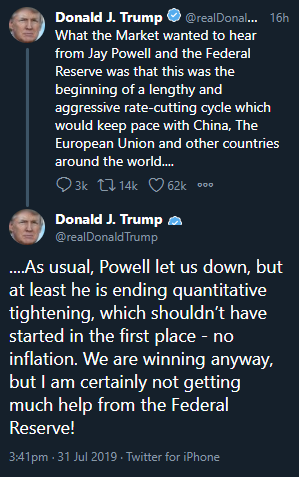

And how do you feel about this Mr. President?

Classic correction in gold/silver prices – while CNBC and every other two-bit blog writer was pounding the table telling you to buy on Tuesday. We could’ve easily been left behind on this but, but our process based decisions thankfully don’t allow us to chase markets at the top of the range. Now, we’ve got a great opportunity to buy back into the things we like on sale.

Oil fell victim to the USD rally yesterday. Textbook sell at the top of the range/bearish 3-6 month trending basis.

The only thing we’re not getting – but might tomorrow – is rising yields. The bond markets not buying any of this FOMC crap, and firmly is telling you that lower rates are still likely coming.

Feel free to reach out to John Caruso at jcaruso@rjofutures.com or 1-800-669-5354 if you’d like to get a 2 month free trial of our proprietary trade recommendations by email.

Also, be sure you sign up for our exclusive RJO Futures PRO simulated demo account here.

RJO Futures PRO Simulated Account includes:

- -$100K simulated trading capital

- -Live Streaming Quotes and Charts to help you test out your trading abilities in real-time.

- -Access to our Professional Trading Desk for advice and free daily research.