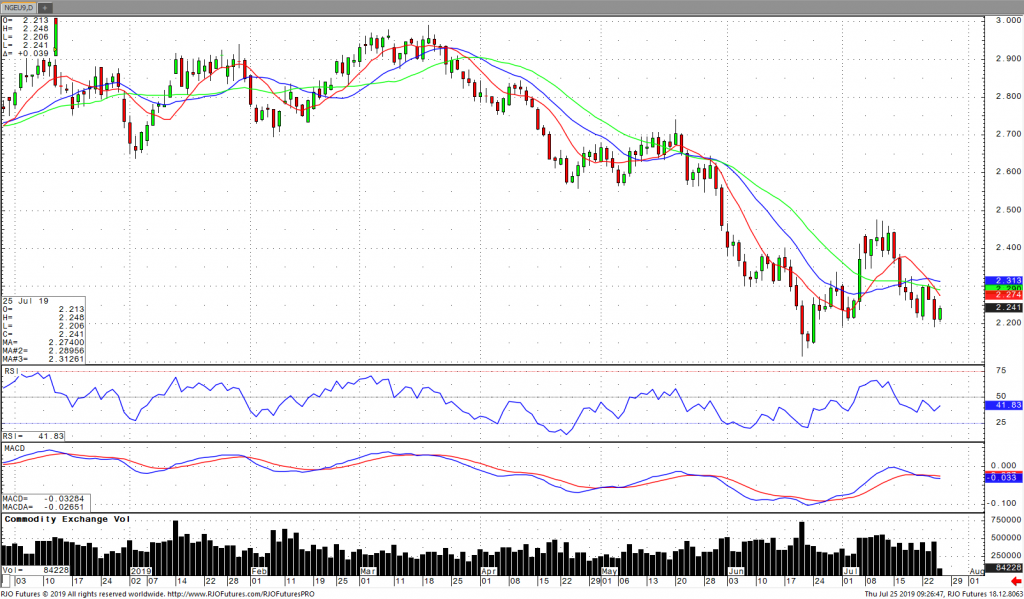

Natural gas is again in a $.10 range between $2.200 and $2.300. Traders love round numbers, so it looks like the $2.200 handle should hold as support. A close above $2.346 should signal a return to the bull camp taking the prices to a higher range. Turning $2.400 and above open to the next resistance levels. Pivot numbers show the market right at the pivot, $2.259 and $2.274 are the next levels up. $2.217 and $2.190 show up as support numbers. However, I don’t think the price will breach $2.200. Moving averages and momentum studies seem to be going sideways.

The injection today is estimated at 40 bcf. The weather is drying out and a muggy weekend and higher temperatures are predicted. China getting back into the trade with reduced tariffs and a small purchase of beans should give some support to the markets. Gas is fairly cheap now, this may bring in some bargain hunters and also give some support to this sideways market. A slightly bullish tint is the way I read this with bottoms around the $2.200 mark.