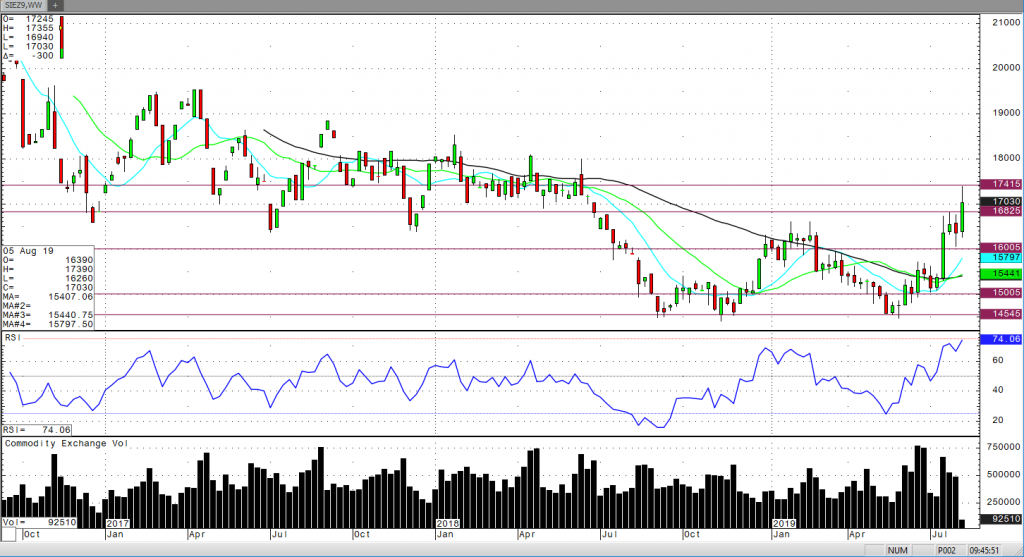

December silver futures have added $1.10 in premium this week alone, finally punching through the $17.00 level of resistance. Now, the December silver contract runs into a ton of “consolidative resistance” between $17.20 up to $17.50. This week’s high, also a new swing high of $17.39, happens to be right smack in the middle of that prior consolidation. So, technically, the market is doing what a chart trader would expect. This is a very impressive rally that was just a slow starter. Think about it this way…silver has rallied $3.00 in three months. That’s $15,000 on a one lot!

So, now a little pull back and maybe the rally takes a “breather” to go sideways for a while, would be healthy for the market. In fact, this rally remains intact all the way down to around $16.60. I’m targeting $18.00 level shorter term and the $20.00 level by the fourth quarter. Watch outside markets like gold, dollar and equites. Use the charts to time when to get in and when to get out. Add on momentum. Don’t over trade and manage the risk accordingly. Work with a professional like myself.

Below is a weekly chart so that you can see the levels that I’m looking at.