While the headline number from this morning’s Non-Farm Payrolls (136k) came in below the 145k estimate, the unemployment rate dropped from 3.7% to 3.5%. The July and August readings were also revised higher. Overall, I would say the jobs number was a net positive. Many thought we’d see the headline figure considerably lower following a couple horrendous ISM readings over the last week or so. That’s not to say we knocked it out of the park here, but I think we threw some water on the recessionary fears for the time being. The rest of the day’s slate of news consists of speeches by members of the Federal Open Market Committee (FOMC), highlighted by Powell at 2:00 PM ET in Washington D.C.

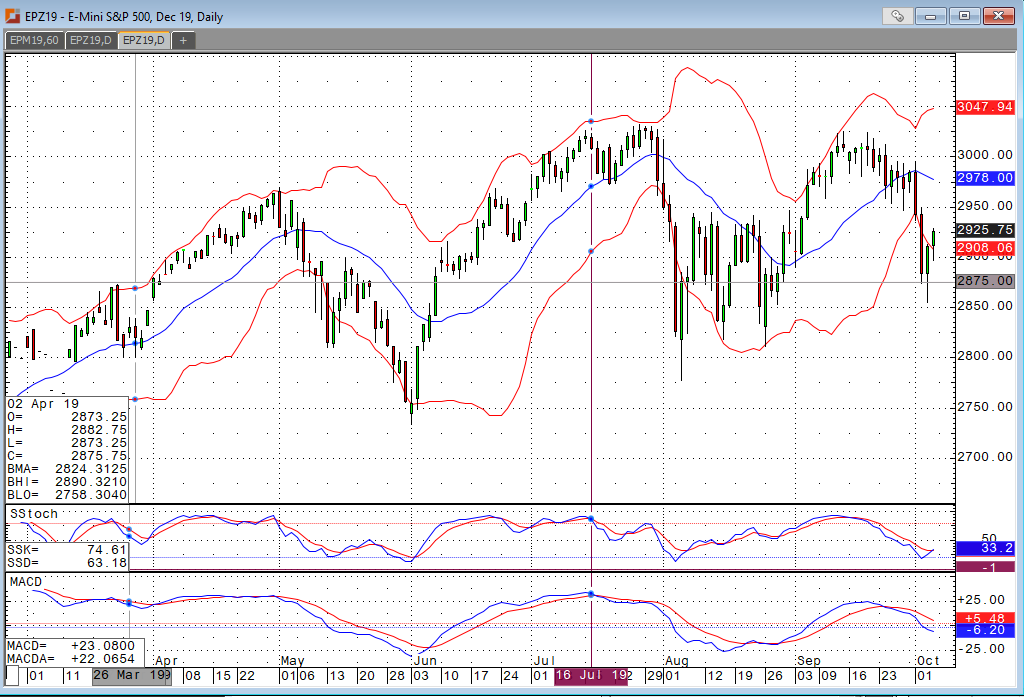

From a technical standpoint, we’re closing in on the 50% retracement level from the 9/13 highs to yesterday’s lows. The daily chart shows a pennant forming with higher lows and lower highs. Often times, this eventually will lead to continued price action in the direction of the overall trend, which was obviously up before entering into some choppier, sideways action.