U.S. government bond prices are rebounding after a three-session decline following Fed Chairman Powell’s testimony to Congress in which he stated that the U.S. economic outlook remains clouded despite the strong nonfarm payrolls number last week and that the Federal Reserve will act as ‘appropriate’ to sustain the recovery – signaling a near term rate cut. Since last month’s meeting, Powell noted that “uncertainties around trade tensions and concerns about the strength of the global economy continue to weigh on the US economic outlook” adding that “inflation pressures remain muted” with core inflation up 1.6% in May, down from 2% in December. Latest projections are for a quarter basis point cut with the market beginning to price in a 58% chance of 50 basis point cut. Yields on the benchmark ten-year note remain bearish trend with today’s range seen between 1.94 – 2.09.

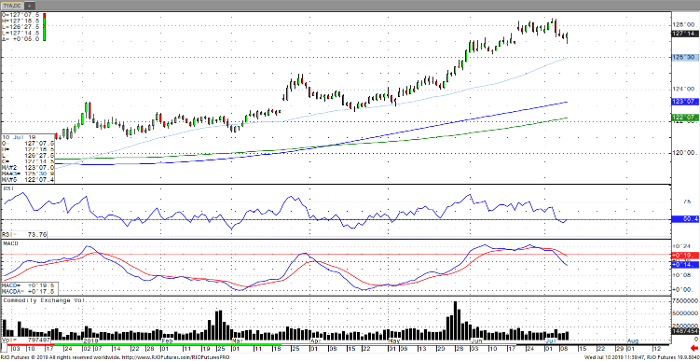

30-Yr Note Sep ’19 Daily Chart