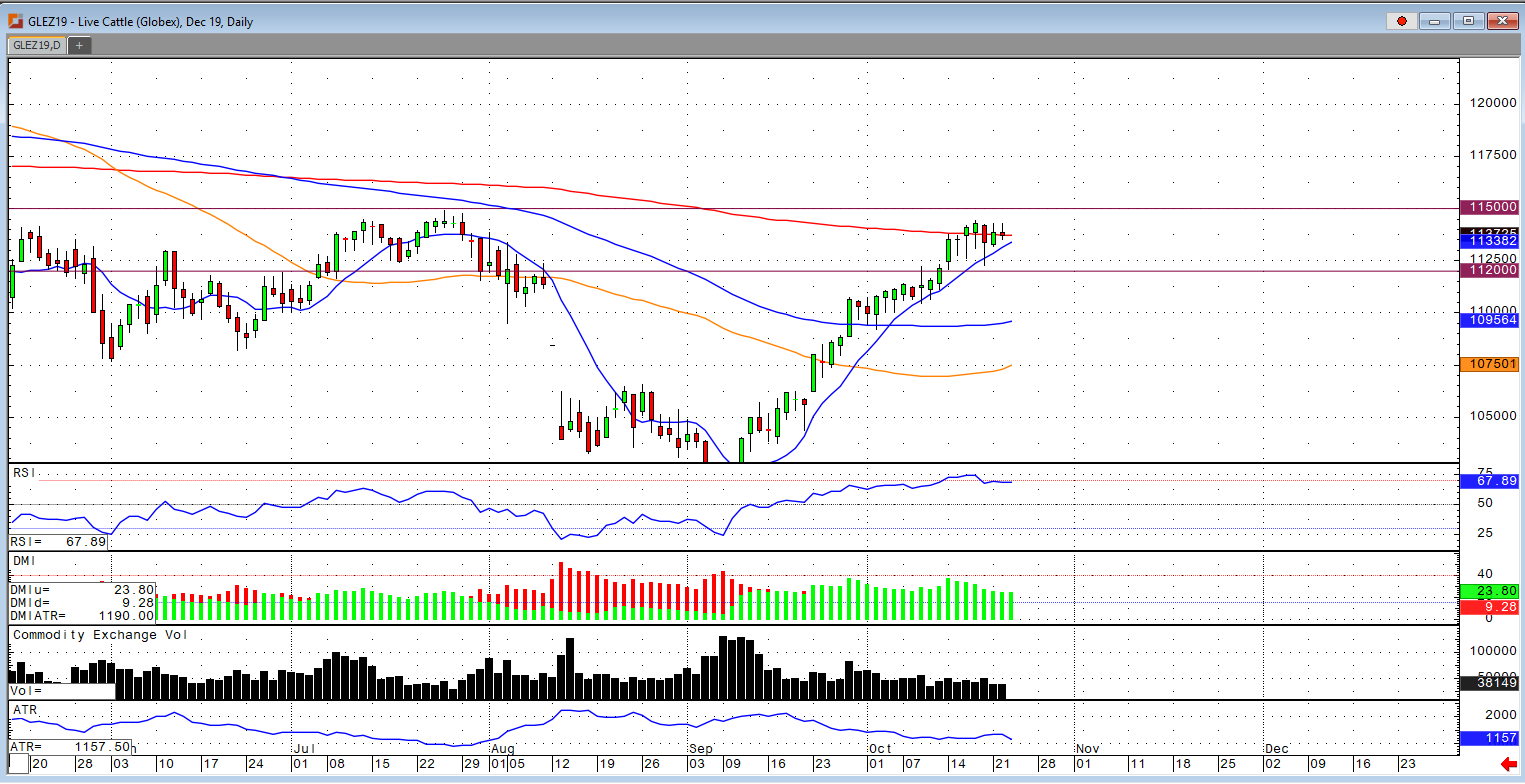

The December cattle market remains overbought technically, but there is no good fundamental reason for sellers to start becoming a more active participant in the market. U.S. beef production is expected to be 120 million pounds lower in the 4th quarter than it was in the 3rd. Last year, production increased by 43 million pounds over the same period and it would also be the first time in 5 years that production increased in the 4th quarter. The USDA boxed beef cutout was up 75 cents at mid-session yesterday and closed 80 cents higher at $220.93. This was up from $218.02 the previous week and was the highest the cutout had been since September 10th. The higher beef trend could support a positive tilt to the cash cattle trade this week. The USDA estimated cattle slaughter came in at 119,000 a head yesterday. This brings the total for the week so far to 237,000 head, up from 235,000 last week, but down from 238,000 a year ago. The cattle on feed report is released on Friday and is expected to only show a modest increase in both the placements and marketings during September and fewer cattle on feed than the previous year. I expect the market to trade sideways for the rest of the week and into next week. If there is a breakout over the $115 level, then I suspect a further run up to the $118 level. If there is a rejection at the $115 level, then expect a retracement down the $112 level.