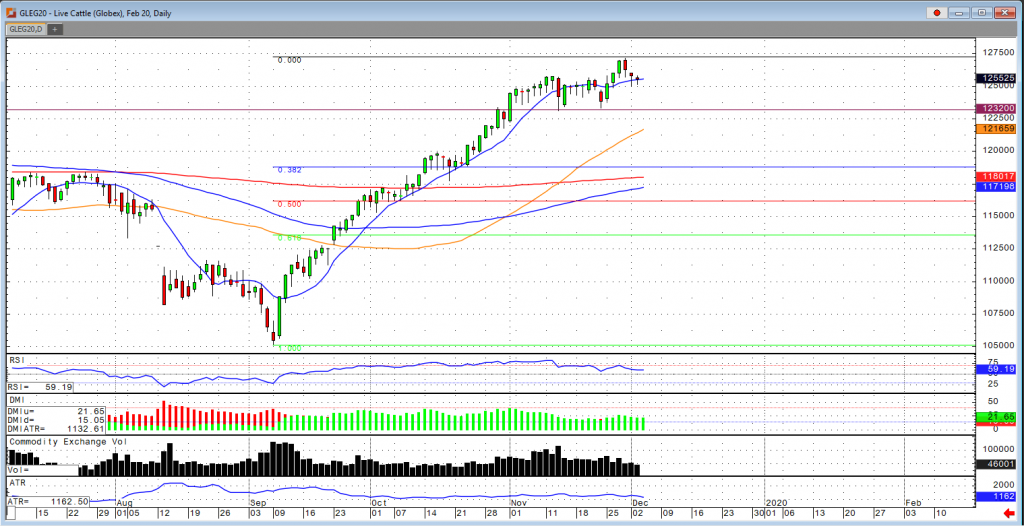

Cattle futures in the February contract have been in consolidation for the past few trading sessions, and for the short-term, there looks to be bearish fundamentals. The premium in the futures market to cash is making producers feed their cattle out to heavier weights, which is looking to increase supply higher than expected. Cash prices in Nebraska traded at $119 on light volume Tuesday. The weather forecast is another bearish factor in the market as it looks to be very dry in the plains. February cattle closed right on the 10-day moving average and looks to take a bounce off of this level and retest the recent highs of 127.15. If it fails to do so due to the bearish fundamental factors, then I suspect the market to fall back to the $123.20 resistance levels. A break through the $123.20 could see some follow through to the $120 price level as a 38% retracement and would have the market fall back to $119. The USDA estimated cattle slaughter came in at 120,000 head yesterday. This brings the total for the week to 240,000 head, up from 225,000 last week, and up from 238,000 a year ago. The USDA boxed beef cutout was down $1.33 at mid-session yesterday and closed $2.46 lower at $230.15. This was down from $233.24 the previous week and was the lowest the cutout had been since October 30.