Fed Minutes: Several participants mentioned that they were debating whether it would be appropriate to keep rates unch at the Mar meeting

Fed Minutes: Several officials stressed the need for policy flexibility.

Fed Minutes: Participants expressed concern that the developments in the banking sector would lead to tighter credit conditions, weighing on activity, hiring, and inflation.

OPEC: World oil demand is to rise by 2.32M bpd in 2023 (Unch from previous forecast)

OPEC: Saudi-led production cuts were in response to uncertainties surrounding demand and increasing inventories

OPEC: Any economic weakness from rate hikes could weigh on the US US summer fuel demand, we see the demand outlook for Europe remaining challenged

US PPI: MM -0.5 vs 0.1 exp vs -0.1 previous

GER CPI Final: YY 7.4% vs 7.4% exp and 8.7% previous

Oil: priced gained +2.2% yesterday – we called out the divergence between price and our OB/OS oscillator – rising price coupled with an OS condition, and that still exists today. I did not act on this, as Oil doesn’t fit the profile nor playbook for the current economic backdrop, but I’m paying attention. Much like stock markets being “centrally planned” via stimulus, what OPEC did last week with production cuts is no different. Oil is very close to moving to BULLISH trend in my TRM grid below, Positive momentum, and still creeping around OS conditions.

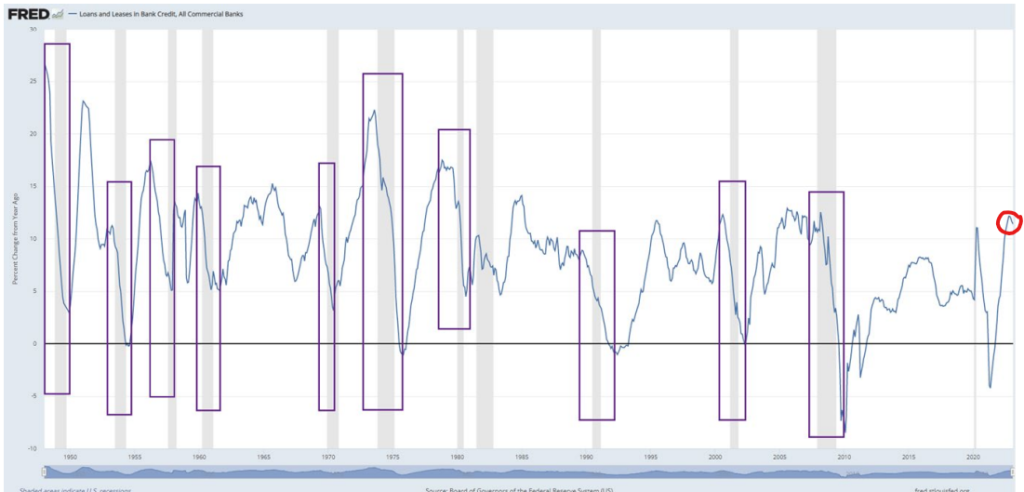

A few chart call outs in regards to Credit Conditions:

Post 1945 aka post-modern-era, a rate of change slowdown in Credit conditions has ALWAYS foreshadowed a RECESSION. Unless the below chart is about to RE-ACCELERATE (which I most certainly doubt), we are on the cusp of tightening to crashing credit conditions. I showed the yield curve yesterday, and coupled with bank liquidity crisis of March …. This is happening.

*Chart credit to St Louis Fed

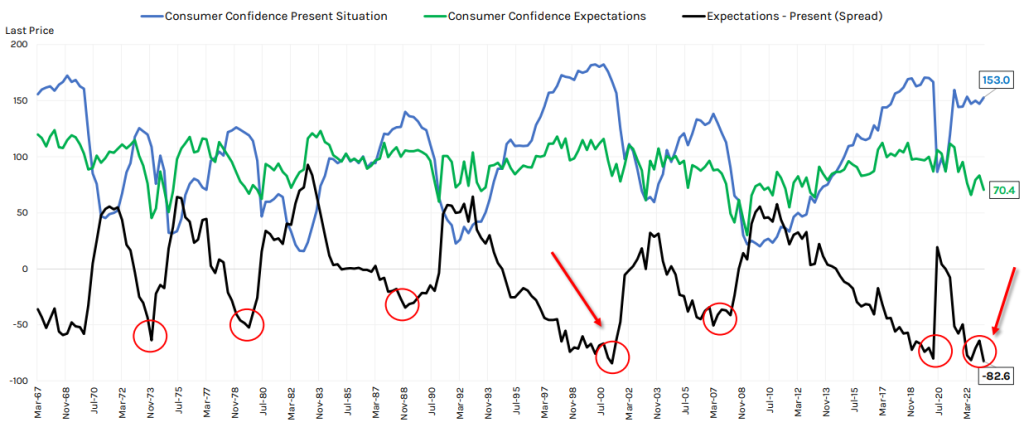

The consumer confidence (present situation) vs Consumer confidence expectations has hit a 22yr low. Since 1970, this spread indicator has foreshadowed an oncoming recession.

*Bonus: Euro 1.1073 top of the range this morning w/ immediate OB signal of 85 – “chart guys” are probably telling you to chase that long here, I’m thinking FADE IT.

Join us for our morning ***Market Insight Letter FREE. Sign up here or email me directly: https://rjofutures.rjobrien.com/trading-offers/trading-coach-insights?cid=7012R0000016hOxQAI

Disclaimer: The risk of loss in futures trading (and or options) can be substantial and each investor/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests or strategies, is not indicative of future results!

Disclaimer

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results.