Russell 2000 Futures

Russell 200 Futures Market

Russell 2000 futures are commodities futures products traded in the equity futures sector. The Russell 2000 tracks the performance of 2000 small-cap U.S. stocks in varying sectors of the U.S. economy. The Russell 2000 is considered the barometer to measure performance of U.S. small cap stocks. The E-mini Russell 2000 futures contract allows traders to speculate and take positions on the performance of the Russell 2000 and in turn, U.S. small cap stocks.

Russell 2000 Futures History

The Russell 2000 was started in 1984 by the Frank Russell Company. However, it wasn’t until 2017 that the CME started offering the Russell 2000 futures contract. Because of its larger grouping of stocks, compares to the S&P 500 and the Dow 30, the Russell 2000 index has evolved over time and is now used as a benchmark to better represent the entire market pool.

Russell 2000 Futures Facts

The Russell 2000 is one of the most diverse futures contracts, offering traders up to 12 different contracts to choose from. Everything from a normal index contact, to weekly options on e-mini index contacts. The Russell 2000 is a great way to get into the small cap market and has options that are suitable to all traders.

Russell 2000 Reconsitution

Once every 12-months, the Russell 2000 index will undergo a reconstitution. This process is done with the goal of reevaluating the index as a whole thus ensuring its accuracy as a represenation of the small cap market place. During this process market capitalization, company rankings, sector compisition, and style orientation are all reevaluatied to better reflecct the current makeup of the market. This reconsitution is met with great care and attention to detail as it directly impacts more than 9-trillion dollars of investor assets.

Trading Russell 2000 Futures

- Russell 2000 futures allow the trader to capitalize on margin offsets on other CME traded equity futures

- Russell 2000 futures require only a 4% initial margin and are coupled with a very high leverage ratio

- Russell 2000 futures are settled on a quarterly basis, with settlement occurring on the 3rd Friday of every December, March, June, and September

- The E-mini Russell 2000 Index Futures Contract trades Sunday through Friday, from 5pm to 4pm central time, with daily trading halts from 3:15 to 4:00pm.

Russell 2000 Futures FAQs

What Stocks Make up the Russell 2000 Index? – The Russell 2000 index consists of 2000 small cap companies. It makes up the bottom two-thirds of the larger Russell 3000 index. Novavax Inc and Waitr Holdings Inc are two of the best performing Russell 2000 companies.

What Are the Sector Weighings of the Russell 2000 Index? – Financial (26%), Industrial (19%), and Healthcare (15%) make up the lion’s share of the Russell 2000 with technology, consumer goods and services, utilities, oil and gas, and telecommunications making up the rest.

How is the Russell 2000 Index Calculated? – The index is calcuated by shares outstanding. Meaning the last sale price and the number of shares available of each member influence the overall index price.

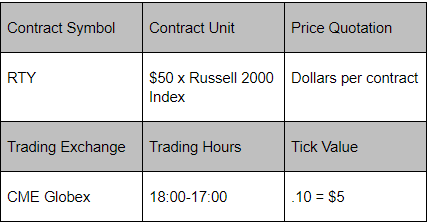

Russell 2000 Futures Contract Specs

RJO Market Update

S-T S&P Mo Failure Insufficient to Conclude Top, But….

S&P Reaffirms Secular Bull, Defines New S-T Risk

Macro Market Update

S-T S&P Failure Insufficient to Conclude Top, But Beware Interim Correction

S&P Closes Year at All-Time High; How to Approach 2024

One Hurdle Remains for S&P to Resume Secular Bull

Macro Market Update

Tighten S&P Bull Risk “Up Here”

Trail S&P Interim S-T Bull Risk to 4,354

Further S&P Losses Reaffirm Peak/Reversal Count, Define New Bear Risk Levels